The changing landscape of the banking and financial sector has contributed to the rising adoption of FinTech in India. FinTech, aka the combination of finance and technology, has pushed modern reformations into customer priorities, adding convenience to the ecosystem. With digital wallets and payment systems, monetary transactions have become quick and secure.

Hence, there is no doubt that popular FinTech apps have gained immense popularity. “FinTech is the future” - we have heard several industrial experts stress it. In recent decades, The FinTech industry has seen enormous growth and proved to become one of the most promising sectors in India.

While the FinTech funding recorded a three-fold jump in 2021, it is expected to reach $1 trillion & $200 billion in revenue by 2030. In India, more than 20+ unicorns have mushroomed in the FinTech sector. This way, our country has been declared a major FinTech hub globally.

What is a FinTech App?

Fintech is an amalgamation of finance and technology. It offers benefits like updating and automating financial processes. At its core, FinTech helps business owners, companies & consumers manage their financial operations in a better manner. It is done by using specialized high-tech software and algorithms.

Today, FinTech has acquired a consumer-oriented approach, comprising other aspects like education fundraising, non-profit, investment management, retail banking & more.

As per the current FinTech Adoption Index of EY, more than one-third of consumers use two or fewer FinTech services as they are critically aware of its advantage in their daily lives. Besides, FinTech also applies to the development and use of cryptocurrencies like Bitcoin.

Examples of Fintech Apps

Here are the top 10 FinTech apps that you should look out for in 2022:

- MoneyLion

- Robinhood

- Nubank

- Coinbase

- Mint

- Revoult

- N26

- Finch

- Tellus

- Chime

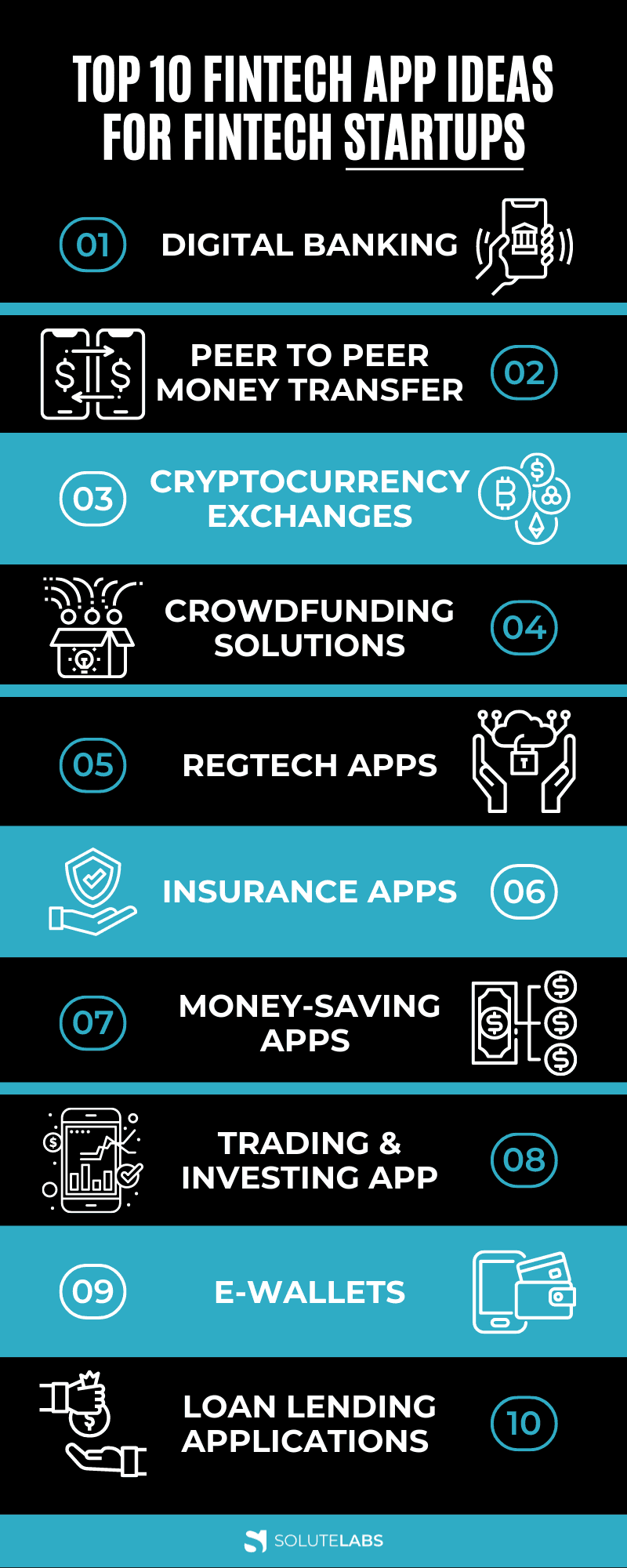

Top 10 Fintech Startup App Ideas

1. Digital Banking

With the rising integration of automation in transactions and traditional banking services, Digital banking is considered among the best FinTech app startup ideas for 2022. It gives people access to countless banking products and services like opening a bank or deposit account, adding beneficiaries, doing EMI management, getting account insights, performing multiple account handling & more. With this mobile app, customers can manage all transactions from the comfort of their homes.

2. Peer-to-Peer Money Transfer App

Given that the majority of the present generation has shifted to online payments, a FinTech startup for Peer to Peer Money Transfer is not only a great FinTech App development idea but also a profitable venture. With Peer to Peer payment solutions, you can transfer money from your mobile phone to your linked bank account. The system is also encouraging the whole world to go cashless.

Some of the features offered by this money-transferring application include:

- OTP or unique ID-based transactions

- Send and receive money

- Split bills and invoices

- Check transaction history

- Check the accumulative account balance

- Change bank details

- Get real-time notifications and alerts

- Utilize the chat feature

3. Cryptocurrency Exchanges

The cryptocurrency exchange is a high-yielding application idea for FinTech startups. It facilitates cryptocurrency trading like for other assets, mainly digital and authorization currencies. It works as a mediator between a retailer and a customer and generates revenue through transaction fees or commissions.

The platform also gives users a huge opportunity to enter the decentralized market. Building a cryptocurrency exchange app can be tricky. So choose the right services after discussing the cost of a FinTech startup app development. Some top cryptocurrency exchange platforms are Bitfinex, Coinbase, Binance & Fundsbarter.

4. Crowdfunding Solutions

Among the many ideas for FinTech startups, this virtual ecosystem is where people can raise money for any group or individual cause. You can collect the donated funds to be able to kickstart a new project. It was during the Covid-19 pandemic that the crowdfunding platform boomed. It is also expected to grow at an astronomical rate in the coming years.

For FinTech startups, there are massive opportunities from the crowdfunding app. The segment is expected to grow worth $300 billion in 2030. A top-notch marketing plan using the crowdfunding app can further help your business reap lasting benefits.

5. RegTech Apps

As a Fintech startup app development idea, RegTech solutions help companies meet regulatory requirements in a time-bound manner. While most people consider it an underrated app for startups, it is one of the most money-making FinTech apps to create.

It can enable institutions to automate processes, such as customer identification, compiling reports, transaction reporting & more. A RegTech platform can help startups manage massive volumes of complex data and process it via Big Data analysis. That way, you can focus more on the areas of improvement.

6. Insurance Apps

Tech companies with insurance products, also called Insurtechs, make for a FinTech startup ideas since it lies at the intersection of insurance and financial technologies. The common belief driving the FinTech founders is that the insurance aspect is ready for a revamp. This app allows people to apply for various insurance policies, pay online premiums, check suitable pricing models, and more.

7. Money-Saving Apps

Every startup should use personal finance management techniques to track spending, plan the budget, manage users' private money, and track savings. All these factors make this idea noteworthy for a FinTech startup.

For a FinTech startup, you can create two types of Money Saving Apps. One is the Habit Tracker to carry out an in-depth analysis of your spending pattern. The other is the Budget Planner, so users can set their spending limits and plan future expenses.

8. Trading & Investing Apps

With more people becoming a part of the investing culture, the FinTech Investing app is a significant FinTech startup app development idea. Using this, you can trade in commodities and market shares.

The custom software development service provider will build this customized platform to timely check investment profits, rate of returns, and revenue margins. Hence, owning an investment/trading mobile app will automatically let your startup profit from the boom in this sector.

9. E-Wallets

Another most in-demand FinTech startup ideas is the E-wallet. Digital payment mediums are being integrated by every e-commerce store since it simplifies and eases payment for buyers. E-Wallets like PayPal have gathered immense fame through direct money transfers between the seller and buyer.

Amazon Pay is another huge wallet that allows purchasers to buy goods without using cash or cards. The convenience offered by the E-Wallets is, therefore, a major reason why they should be merged into FinTech startups.

10. Loan Lending Applications

Finally, these FinTech apps boost startups & address the customers' major pain points. Often, it becomes difficult for the lender and borrower to meet physically and discuss price rates.

A loan lending application can seamlessly connect the borrower to a suitable lender. They can browse through the list of interested money lenders in a project and contact them for more discussions. Here, you can negotiate loan rates while also being a vital gainer from the funding.

Also, Read: Effective Tips for Fintech Mobile App Developers

Reasons to Invest in FinTech App Development

With the changing global economy, FinTech mobile app development will become the driving factor for persuasive investments, inviting big industry entrants to invest heavily in FinTech startups. The FinTech mobile app ideas for startups are also revolutionizing how companies or startups do business now.

From lowering development and maintenance costs to enhancing business development, market research, customer engagement, and sales opportunities, FinTech Apps are a go-to-deal to start your own business. The apps also guarantee steady growth and better business ROI over the years.

Also, read: How to Navigate Fintech Regulations in Product Development

Ready to Build your FinTech Product?

For most FinTech Startups, gathering FinTech app ideas has become crucial to the flourishing of the business. The ideas should be productive, besides being unique & brainstormed to get amazing results.

So, if you are a founder, innovator, or product manager looking for cutting-edge FinTech startup ideas to awe potential investors, connect with us for high-end FinTech software solutions. Meet our FinTech experts and begin your journey of building the greatest FinTech App of all time.